40+ Paying additional on mortgage calculator

An ARM has a fixed rate for a set time for example five seven or 10 years and then adjusts periodically for the remaining. The IRS guidelines list the following requirements.

Credit Cards Numbers That Work Order 1578609875 On Jan 28 2020 Credit Card Tracker Credit Card Payment Tracker Credit Card Payoff Plan

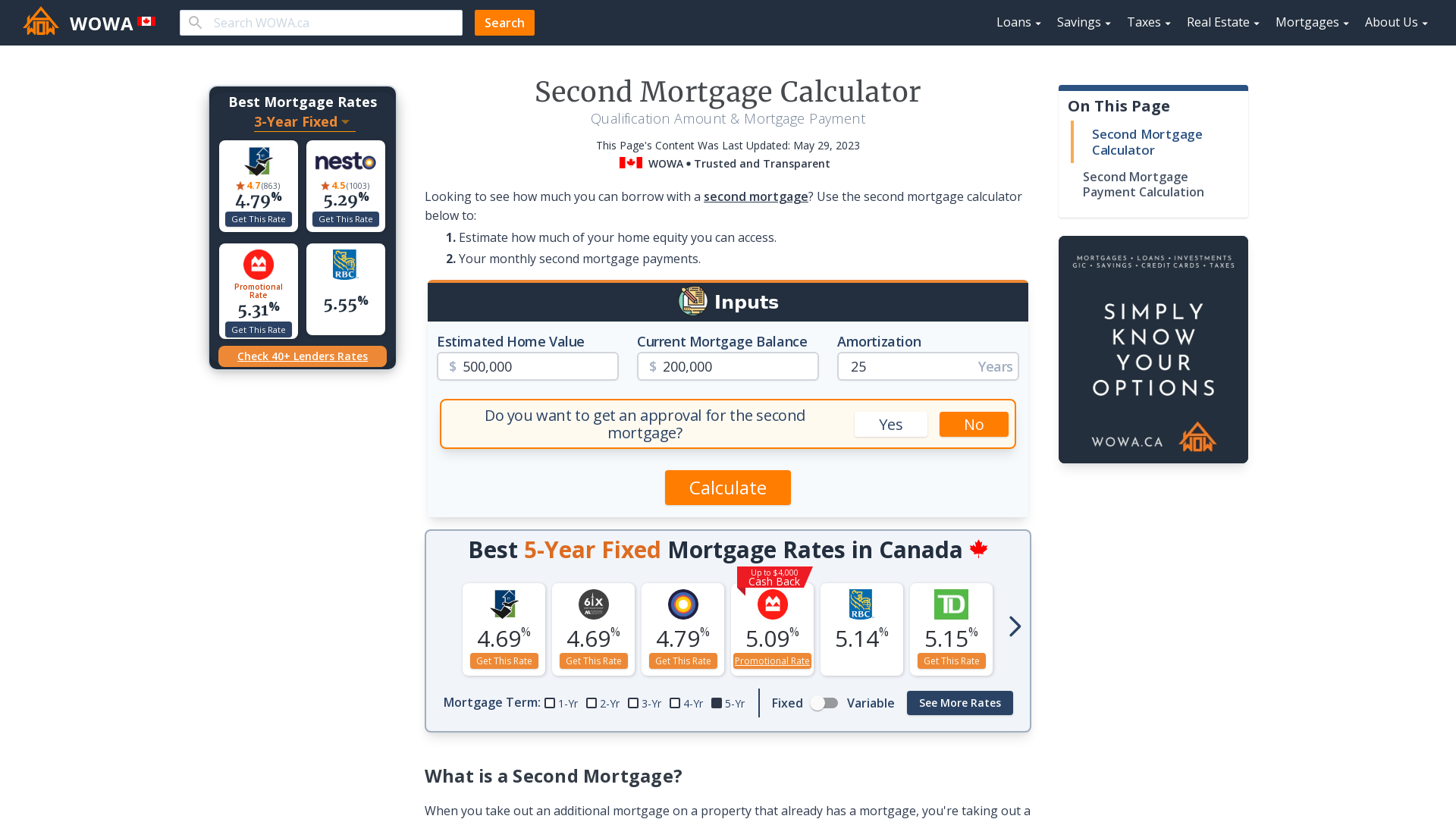

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the mortgage in full.

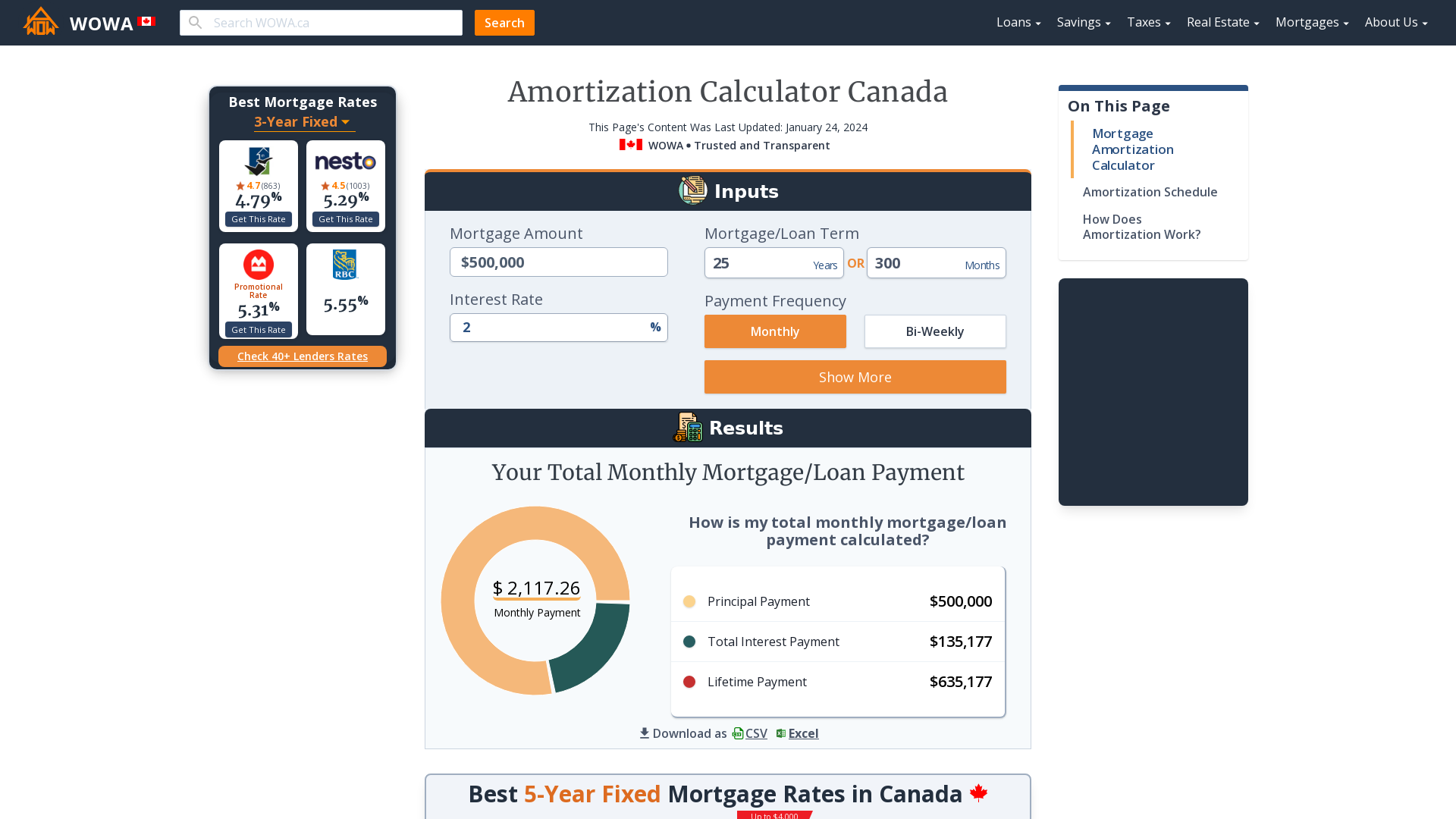

. Our calculator includes amoritization tables bi-weekly savings. Mortgage Calculator With PMI is a mortgage amortization calculator that has an option to include Private Mortgage Insurance or PMI. Mortgages are how most people are able to own homes in the US.

Following this you would be eligible to apply for a Nationwide mortgage of up to 75 or 55 for Greater London of the homes purchase price. Continuing with the above example the revised mortgage amount would be 260000 8060 268060. The accelerated weekly payment is calculated by dividing your monthly payment by four.

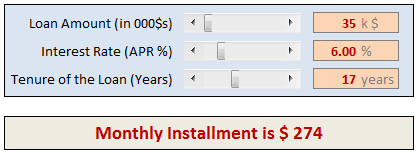

Has all the variables built in so that you can estimate exactly how much you will be paying each month. This is how much you would need to borrow from your lender in order to purchase your home. Check out the webs best free mortgage calculator to save money on your home loan today.

Paying points is an established business practice in the area where the loan was made. Paying extra on. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage.

We do not offer additional loans above a maximum LTV of 85 including your existing mortgage. In addition to making extra payments another great way to save money is to lock-in historically low interest rates. Paying cash for a home may sound weird but imagine all the fun youd have without a mortgage payment weighing you down.

What Mortgage Can I Afford Calculator. There is a difference between amortization and mortgage termThe term is the length of time that your mortgage agreement and current mortgage interest rate is valid for. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. A 40-year mortgage with a variable rate Borrowers can get an adjustable-rate mortgage ARM with a 40-year term. Most people need a mortgage to finance a home purchase.

Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term. The PMI is calculated only if the down payment is.

The mortgage amortization period is how long it will take you to pay off your mortgage. A mortgage usually includes the following key components. The effect can save you thousands of dollars in interest and take years off of your mortgage.

A 40-year mortgage extends the mortgage term by 10 years when compared with a traditional 30-year mortgage. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages.

These are also the basic components of a mortgage. With the rise of technology and automation who knows what the world would look like in a quarter century. The most common mortgage term in Canada is five years while the most common amortization period.

Home mortgage points are tax-deductible in full in the year you pay them or throughout the duration of your loan. Maximum additional loan term is 25 years if any element of your mortgage is on interest only. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands.

You only pay interest on 180000 of the mortgage. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. With a 5 deposit an additional 20 or 40 in Greater London can be borrowed through the Help to Buy equity program to be put towards the purchase price of a property.

Discover how much you could borrow and what it could cost with our easy-to-use mortgage calculator from Principality Building Society. You would then make 52 weekly payments. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

A one-time additional payment of 1000 towards a 200000 30-year loan at 5 interest can pay off the loan four months earlier saving. Instead of paying say 3 interest on 200000 in a year 6000 youll only pay 3. Instead your mortgage default insurance premium is added to your mortgage amount and paid off over the life of your loan.

When borrowers put down less than 5 they are typically charged a significantly higher interest rate to offset the additional risk the lender is taking. Your main home secures your loan your main home is the one you live in most of the time. Just like the accelerated biweekly payments you are in effect paying an additional monthly payment each year.

Forbes Advisors Mortgage Calculator uses home price down payment and other loan details to give you an estimate calculation on your monthly mortgage payments. If you cant postpone the purchase until you can pay cash plan to make a down payment of 1020.

Free Accounting Spreadsheet Templates For Small Business Xls With Regard To Small Budget Planner Template Budget Spreadsheet Template Budget Planner Printable

Nwiozvluu7kdum

Pin On Apply For Us Passport

Pin On Get Out Of Debt Pay Off Debt

Fbkrro80 Lcsmm

Borrow Loan Company Responsive Wordpress Theme Loan Company Amortization Schedule The Borrowers

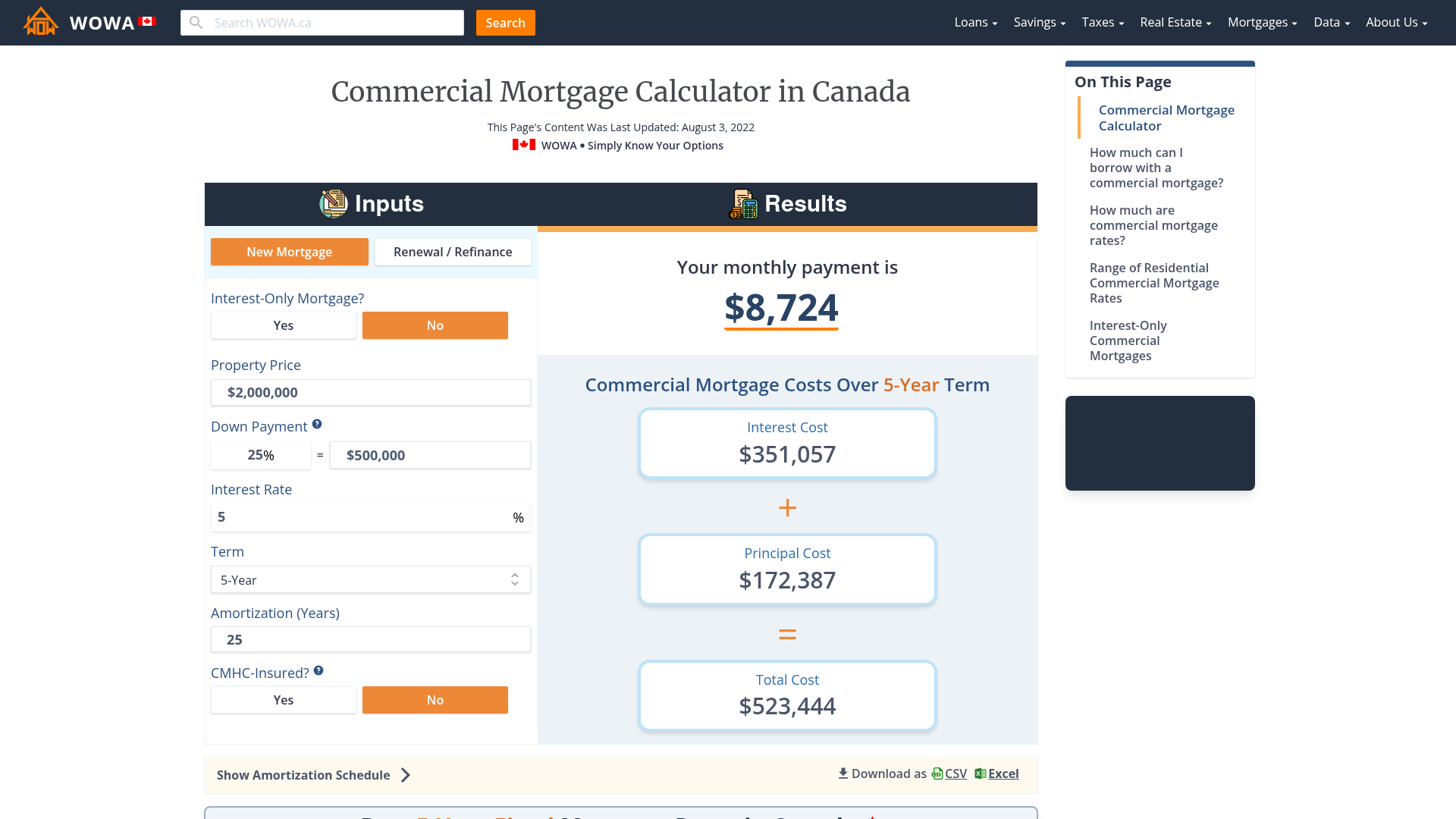

Commercial Mortgage Calculator Payment Amortization

Payroll Calculator Template Free Payroll Template Payroll Business Template

Mortgage Amortization Calculator Canada Wowa Ca

12 Sample Simple Budget Templates Simple Budget Template Monthly Budget Template Budget Template

How To Use A Mortgage Calculator Comparewise

Mortgage Interest Calculator Principal And Interest Wowa Ca

Simple Loan Agreement Telugu Resume Template Free Loans For Intended For Collateral Loan Agreement Template Contract Template Personal Loans Private Loans

Join The Real Estate Bloggers Community On Reddit Real Estate Articles Real Estate Real Estate Tips

Pin On Comment Card Rockstars

Mortgage Payment Calculator Mortgage Calculator Using Microsoft Excel

Toolbar Customization Winforms Controls Devexpress Help Toolbar Custom Bar Items